ABOUT THE REPUBLIC OF ABKHAZIA

ABOUT THE SEZ PROJECT IN WORLD PRACTICE

We express our respect to you and provide you with information about the AMRA SEZ project in Abkhazia from the ASTIKO MANAGEMENT COMPANY.

SPECIAL ECONOMIC ZONES

as a mechanism for effective development

International Investment and Innovation Activities.

PROSPECTS FOR THE DEVELOPMENT OF THE SEZ "AMRA" NEW MEGA-PROJECT OF THE SEZ "AMRA"

GLOBAL MARITIME HUB on THE BLACK SEA

AMRA SPECIAL ECONOMIC ZONE

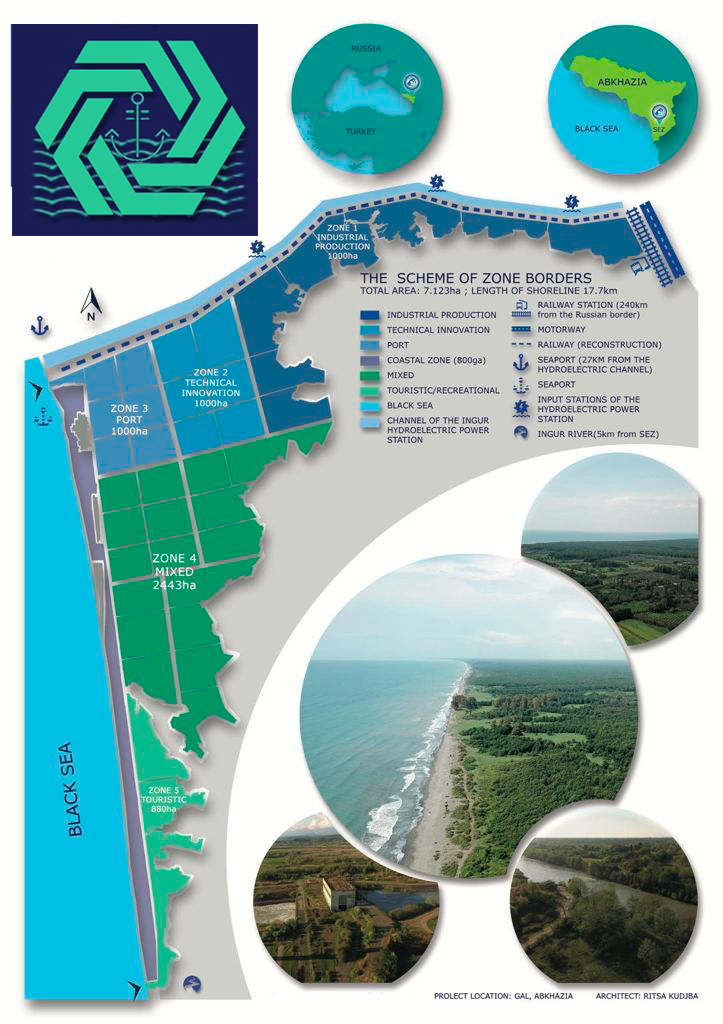

The SPECIAL ECONOMIC ZONE "AMRA" (SEZ "AMRA") was created by DECREE of the PRESIDENT of the Republic of Abkhazia on December 30, 2016 No. 388 within the framework of Law No. 3893-c-V "On Special Economic Zones", a total area of 7123 hectares was created, adjacent to 17 km of the Black Sea coastline. The term of operation of the SEZ is 49 years, until 12/30/2065. The location of the SEZ "AMRA" is the Galsky district of Abkhazia.

Coordinates of the territory: 42°33'32.4"N 41°33'31.6"E.

All the powers to manage the SEZ "AMRA" are assigned to the private management COMPANY of the Management Company "R-ASTIKO" (hereinafter referred to as the Management Company "ASTIKO").

The FREE CUSTOMS ZONE OF THE SEZ "AMRA" along the perimeter is the CUSTOMS BORDER of the Republic of Armenia and the regime of the free customs zone operates.

RESIDENT OF THE SPECIAL ECONOMIC ZONE

An individual entrepreneur or a commercial organization from the date of making the corresponding entry in the register of residents of the Special Economic Zone.

RESIDENTS OF THE SEZ "AMRA" ARE EXEMPT FROM ALL TYPES OF TAXES FOR HALF THE TERM OF THE contract with THE ASTIKO Management Company, except for taxes on wages and extra-budgetary funds of the Republic of Armenia.

Attractive conditions for investors and residents in the SEZ "AMRA": security, tax preferences, minimum bureaucracy and formalities, transparent and understandable legislation, simplified registration procedures.

PORT TYPE OF SEZ

Abkhazia is the shortest route for transit transportation of goods through the Black Sea..

TOURIST AND RECREATIONAL TYPE

Creation of a modern multifunctional recreational all-season complex of the world level. Considering the location of the SEZ "AMRA" - its coastal territory, flat terrain, mild subtropical climatic conditions, are clear advantages for those who want to develop their business in the traditional industry of the republic - tourism.

Citizens of Russia, Dubai, Singarur, India, Turkey, Switzerland ... and any other citizens of foreign States can register their company in the SEZ "AMRA" as a resident in the tourist and recreational type and legally obtain the right to lease and use the land for 49 years.

To build, for example, a hotel complex with the help of the ASTIKO Management Company and issue a Certificate of registration of an object of immovable property in the register of private property of Abkhazia and then own it indefinitely.

SEZ "AMRA" IS AN OASIS OF OPPORTUNITIES FOR INVESTMENT and BUSINESS!

SEZ "AMRA" is a limited territory, with a special legal status in relation to the rest of the territory and preferential economic conditions for national or foreign entrepreneurs.

SEZ "AMRA" is the introduction in the country of best practices in the functioning of a single territory, analogues of which exist in many economically advanced countries. It is well known that the special legal status of such territories gives its residents a long-term opportunity to work in favorable economic conditions and create a more competitive product by minimizing their own expenses and fiscal burden on the part of the state and improving its financial performance.

SEZ "AMRA" - a platform for business, investment and the formation of a high–tech economy - is the best mechanism for the effective development of international investment and innovation activities.

THE PURPOSE OF the CREATION of the SEZ "AMRA" is to increase exports and foreign direct investment, which will bring more income to the population, as well as contribute to economic growth and the creation of a balanced economy.

Attracting private capital and involving it in the development of the national economy. The implementation of this program will give a serious boost to the socio-economic development of the country as a whole.

ADMINISTRATION OF SEZ "AMRA" MANAGEMENT COMPANY "ASTIKO"

The benefit everywhere and always depends on the observance of two conditions:

1) the correct establishment of the ultimate goal of any kind of activity

2) finding the appropriate means leading to the final goal.

Aristotle

MISSION AND VISION OF ASTIKO MANAGEMENT COMPANY:

Creation of a new, unique format for Abkhazia, integrated into the world economy and the most attractive place for residents to do business! Attract investment and promote entrepreneurship.

Stimulating economic growth, declaring the SEZ as an international economic center and improving the social well-being of the population by providing the most favorable conditions for attracting investment.

SEZ "AMRA" provides the most favorable conditions for attracting investments in the following areas: transport (maritime, railway) infrastructure, the introduction of high-tech industries, international trade, tourism.

The MANAGEMENT COMPANY "R-ASTIKO" - assumed responsibility for the development of the concept, business and general plan of the project, to carry out the construction and Management of the SEZ "AMRA". We are for the involvement of land resources in the economic turnover of the country.

ASTIKO MANAGEMENT COMPANY

THIS IS A TEAM OF EXPERIENCED INTERNATIONAL MANAGERS

The location of the SEZ "AMRA" is Galsky district, Republic of Abkhazia. 42°38' s. w. 41°44' The territory of the SEZ "AMRA" is 7123 hectares, including 17 kilometers of the Black Sea coast. Coordinates of the territory of the SEZ "AMRA": 42°33'32.4"N 41°33'31.6"E

In the modern world there can be no development without private investment.

The creation of the SEZ "AMRA" is not only an effective incentive to accelerate and improve the quality of various aspects of the life of the economy and society, but also a very capital-intensive process.

The implementation of this project requires the attraction of substantial investments and highly qualified personnel. To this end, we have formed a team of highly qualified specialists, managers and professionals who have experience in such projects and are able to take responsibility for its implementation now in Abkhazia.

PROJECT TEAM

We believe that working together with "brand people" who are very important in the global economy is a serious basis for the success of the project as a whole.

A group of experts from Turkey, India, Brazil and the United Arab Emirates is also ready to invest its extensive experience in the project, ensure the attraction of private investment in projects on the territory of the AMRA SEZ and organize the export and marketing of products in the countries of the Asia-Pacific region.

The team's philosophy is to harmoniously combine environmental care and technological progress. This is achieved through the most efficient use of resources, careful attitude to the environment and close mutually beneficial cooperation of the participating companies.

THE LEADER OF THE CONCEPT IN THE DEVELOPMENT OF THE ECOLOGICAL AND ECONOMIC TERRITORY OF THE SEZ "AMRA", is based on the principles of sustainability, combining a reasonable attitude to production, consumption and the environment. In the zonal structures of the latest generation, namely in the ecological and economic territory of the SEZ "AMRA", the principle of building a model of a future civilization that will be able to provide a sufficiently high standard of living for people while preserving natural ecological systems will be worked out.

PREREQUISITES AND DEVELOPMENT POTENTIAL.

The advantage of the project is to reduce the time and cost through a new transport corridor.

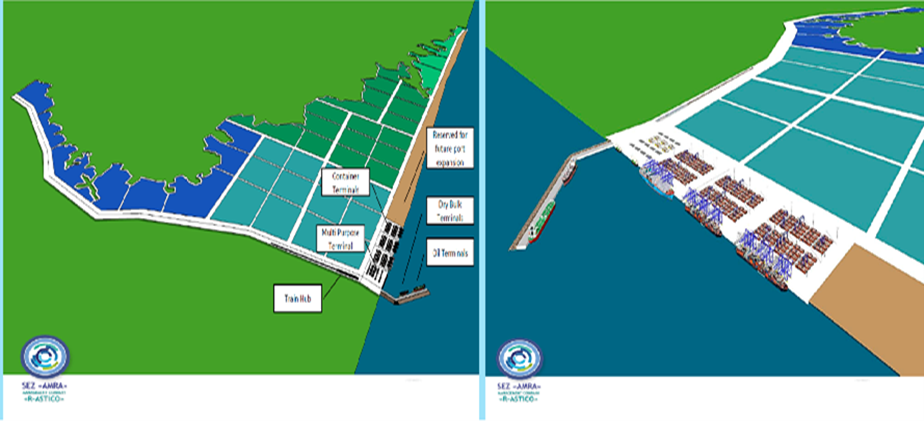

The main advantage of the creation of the SEZ "AMRA", in addition to stimulating investment activity, is also the organization of a powerful modern Transport and Logistics Center on the basis of the SEZ, the main part of which should be the "Deep-water Seaport".

SEZ "AMRA" IS THE SHORTEST WAY CONNECTING ASIA WITH EUROPE

The geographical location of the SEZ "AMRA" will give a real chance to become an active member, and possibly a leader in the development of the Transcaucasian transport corridor connecting Europe with Asia.

ADVANTAGES AND KEY FEATURES OF THE SEZ "AMRA"

- The special legal status of SEZ "AMRA" gives its Residents a long-term opportunity to work in favorable economic conditions and create a more competitive product by minimizing their own costs and fiscal burden from the Statesa.

- ASTIKO MANAGEMENT COMPANY provides investors, residents, land plots for construction, and in the future, ready-made buildings and structures for starting a business.

- ASTIKO Management Company is ready to provide services to a Resident on the principle of "one window";

- It is located on the Black Sea coast, 17 km long, a unique portside plateau for the Black Sea coast to accommodate warehouse and production complexes;

- The production of excisable goods is allowed;

- Equal rights for enterprises with full or partial participation of foreign capital;

- 100% ownership of the company by a foreign owner is allowed;

- Registration of international certificates in the SEZ "AMRA";

- Smart Grid solutions (smart networks);

- Design of small local solar power plants, selection of rational solutions for short- and long-term storage of green energy (electric and hydrogen energy storage);

- Preparation of operational facilities for integration into the "Smart City";

- The duty-free trade regime of the Republic of Armenia with the Russian Federation is an additional factor in favor of the project. To apply this mode, a CT1 certificate is required;

- Residents of the SEZ "AMRA" will have the opportunity to bring their production closer to the extremely capacious market of the Russian Federation;

- In addition to the ready-made infrastructure, resident companies receive a number of benefits in accordance with the RA Law "On SEZ":

RELIABILITY AND SAFETY OF INVESTMENTS

ACTIVITIES AND PROPERTY OF RESIDENTS

- Entry into the zone is carried out through a checkpoint and a customs control area.

- Perimeter security is performed by the Management ASTICO Company".

- It will be based on the principles of "smart city", "safe city".

- Centralized protection of facilities and the entire territory.

- Conclusion of an insurance contract with residents.

- Acts of the RA legislation on taxes that worsen do not apply to residents of the SEZ "AMRA" (SEZ law).

- The property, Assets or activities of Residents in the SEZ "AMRA" are not subject to nationalization or any measures restricting private property. Chapter 9. Article 40. paragraph 2 of the RA Law on "SEZ".

- Any disputes are referred for consideration to the agreed international arbitration court, Chapter 9, Article 41, paragraph 2 of the Law "on SEZ".

- The development of international business in the SEZ may sometimes be accompanied by the emergence of disagreements between the parties to the relationship. International arbitration is one of the most effective ways to resolve such legal disputes. International arbitration resolves foreign economic disputes arising between two economic entities of foreign economic activity, regardless of their political status. The country of the international arbitration can be agreed upon at the conclusion of the contract with the SEZ Resident himself (Russia, Dubai, Switzerland, Singapore, etc.).

BENEFITS AND PREFERENCES

- Minimal administrative barriers.

- Administrative benefits — simplified procedure for registration of enterprises, simplified procedure for entry and exit of foreign citizens, unhindered export of legally obtained profits by foreign citizens abroad;

- Assistance in the implementation of the investment project at the first stage of its development, as well as its further support by the ASTIKO Management Company;

- Tax benefits and customs preferences;

- Trade, or customs (import) benefits full exemption from import duties on semi-finished products, raw materials, etc., imported for use within the zone;

- Customs (export) benefits — full exemption from export duties on products manufactured within the zone.

BENEFITS AND PREFERENCES OF THE SEZ "AMRA"

- На ПОЛОВИНУ СРОКА действия соглашения об осуществлении деятельности в ОЭЗ «АМРА» освобождаются от всех ВСЕХ ВИДОВ НАЛОГОВ, за исключением подоходного налога с заработной платы работников и платежей во внебюджетные фонды РА.

- ЗАКОНОДАТЕЛЬСТВОМ РА УСТАНОВЛЕНЫ РАВНЫЕ ПРАВА ДЛЯ ПРЕДПРИЯТИЙ С ПОЛНЫМ ИЛИ ЧАСТИЧНЫМ УЧАСТИЕМ РОССИЙСКОГО ИЛИ ЛЮБОГО ИНОСТРАННОГО КАПИТАЛА.

- МЕЖДУНАРОДНАЯ и «ОРГАНИК-СЕРТИФИКАЦИЯ» - ОФОРМЛЕНИЕ. В ОЭЗ «АМРА».

- ДОПУСКАЕТСЯ 100% ВЛАДЕНИЕ КОМПАНИЕЙ ИНОСТРАННЫМ СОБСТВЕННИКОМ.

- РЕЗИДЕНТЫ ОЭЗ «АМРА» ПОЛУЧАТ ВОЗМОЖНОСТЬ ПРИБЛИЗИТЬ СВОЕ ПРОИЗВОДСТВО К ЧРЕЗВЫЧАЙНО ЕМКОМУ РЫНКУ РФ.

- РАЗРЕШЕНА ПЕРЕРАБОТКА ПОЛЕЗНЫХ ИСКОПАЕМЫХ, ПРОИЗВОДСТВО ПОДАКЦИЗНЫХ ТОВАРОВ, ВЫЧИСЛИТЕЛЬНЫХ ЦЕНТРОВ И ИХ РАЗНОВИДНОСТЕЙ;

- РЕЖИМ БЕСПОШЛИННОЙ ТОРГОВЛИ РА С РФ, ЯВЛЯЕТСЯ ДОПОЛНИТЕЛЬНЫМИ ФАКТОРАМ, ДЛЯ ПРИМЕНЕНИЯ РЕЖИМА НЕОБХОДИМ СЕРТИФИКАТ СТ1.

ONLY THE FOLLOWING TAXES APPLY IN THE SEZ

- PERSONAL INCOME TAX 10%TAX

- PAYMENTS TO EXTRA-BUDGETARY FUNDS 20%

- TOTAL 30%

- ON PROPERTY 0%

- ON PROFIT 0%

- FOR TRANSPORT 0%

- VAT 0%

THE REGIME OF THE FREE CUSTOMS ZONE OF THE SEZ "AMRA"

The perimeter of the free customs zone - the outer part of the fence of the SEZ "AMRA" is the CUSTOMS BORDER of the Republic of Armenia and the regime of the FREE CUSTOMS ZONE (duty-free import of equipment, raw materials, building materials) operates.According to the Law of Abkhazia "on SEZ":

The CUSTOMS OGAN of the Russian Federation on the territory of Abkhazia and the Abkhazian customs post (specialized) perform the same functions as at the Russian customs post "Psou" and in the SEZ "AMRA" in online mode.

Road checkpoints;

Inspection platform;

Customs Control zone;

Car scales.

Coordinated clearance of customs duties and goods arrive in and out of the SEZ "AMRA" without unnecessary delays, transit through the border "Psou".

ABKHAZIA HAS A DUTY-FREE TRADE REGIME WITH THE RUSSIAN FEDERATION.

In the SEZ "AMRA" there is a regime of a free customs zone (import of raw materials, equipment without payment of customs duties, import duties, VAT and excise taxes).

ADVANTAGES OF THE PROCEDURE OF THE FREE CUSTOMS ZONE (FTZ) for RESIDENTS OF THE SEZ "AMRA":

No costs for temporary storage warehouse;

The possibility of duty-free placement of foreign goods on the territory of the SEZ for an almost unlimited amount of time;

A free customs post in the "one window" mode.

CUSTOMS PRIVILEGES OF THE SEZ

- DUTIES 0%

- VAT 0%

- EXCISE TAXES 0%

All these benefits are given in exchange for certain obligations on the volume of investments, under the Resident's contract with the ASTIKO Management Company.

ONLY THE FOLLOWING TAXES APPLY IN THE SEZ

- PERSONAL INCOME TAX 10%TAX

- PAYMENTS TO EXTRA-BUDGETARY FUNDS 20%

- TOTAL 30%

- ON PROPERTY 0%

- ON PROFIT 0%

- FOR TRANSPORT 0%

- VAT 0%

CURRENT LOGISTICS INFRASTRUCTURE

The plots of the SEZ "AMRA" are ready to be leased to residents.

SEZ "AMRA" has all the necessary primary infrastructure that

it will allow the Resident to quickly increase production capacity, without a long wait for the construction of vital facilities.

Currently, part of the territory of the SEZ "AMRA" is provided with engineering communications – water intake nodes, sewage, sewage treatment plants, electrical networks, access roads and an interchange with the federal highway. The connection points are located in the immediate vicinity of the border of the SEZ "AMRA".

On the outer border of the territory of the SEZ "AMRA" there is a design of the differential Ingur HPP – its own generation of cheap energy is possible.

The connection of the sea border of the SEZ "AMRA" and the beginning of the mouth of the deep-water (30 meters), protected, drainage channel of the delta Ingur HPP is also possible for working with river-sea vessels.

At a distance of 20 km from the SEZ "AMRA" there is a "seaport" with a depth of 8 meters, used for container transportation, metals and coal transshipment. Adjacent railway line from the Russian Federation.

A big positive factor is the fact that there are trunk railways and highways nearby, with which the "dry port", "seaport" and in the future the "deep-water seaport" are already connected by appropriate communications, and which only need rehabilitation and modernization.

Also on the territory of the SEZ "AMRA"

WATER SUPPLY OF SEZ "AMRA"

24 artesian wells 17 m3/hour

RAILWAY LINE

It is adjacent to the current port 20 km from the port part of the SEZ, enters directly into the port of Ochamchira, as well as directly to the border of the SEZ.

THE CURRENT PORT OF OCHAMCHIRA

At a distance of 20 km from the SEZ, a seaport with a depth of 8 meters is already operating today, used for container transportation, metals and coal transshipment

electricity

The point of connection to electric networks on the border of the SEZ "AMRA"